Unlocking the Success Story of CDSL Shares

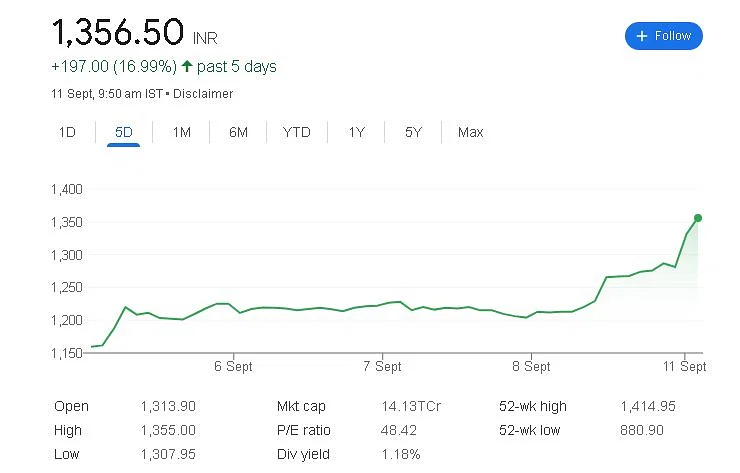

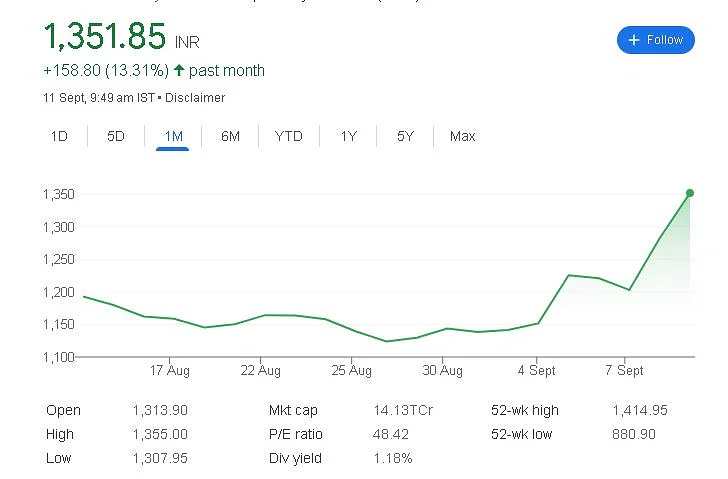

Central Depository Services (CDSL) shares kicked off the week with a flourish, opening at Rs 1,308 on Monday, briefly dipping to Rs 1,327.85, only to skyrocket to Rs 1,353.10, marking an impressive 5.56% surge. Over the past five days since Ambit’s ‘buy’ recommendation, CDSL shares have seen a remarkable 16.99% climb. The stock’s breakout from horizontal resistance, robust bullish candlestick patterns, and strong technical indicators signal a bullish trajectory. Ambit’s optimistic outlook, targeting Rs 1,400, suggests a potential 22% upside in CDSL’s stock price, emphasizing its strategic position in India’s growing equitisation landscape.

The Rise of CDSL Shares

In the ever-evolving landscape of the Indian stock market, CDSL shares have emerged as a standout performer. The week started with a bang as CDSL shares opened at Rs 1,308 on Monday, setting the stage for an exciting journey ahead. Investors and market enthusiasts eagerly awaited the unfolding events.

Ambit’s ‘Buy’ Recommendation

One of the pivotal moments in this remarkable journey was Ambit’s ‘buy’ recommendation. This endorsement from a renowned financial institution was the catalyst that set CDSL shares on a path to significant gains. But what prompted Ambit’s optimistic outlook?

Ambit’s Optimistic Outlook

Ambit’s analysts have their finger on the pulse of the market, and when they predict a potential 22% upside in CDSL’s stock price, it’s time to take notice. This optimistic outlook is rooted in a thorough analysis of the stock’s performance, technical indicators, and market trends.

The Bullish Trajectory

CDSL’s journey wasn’t just about opening strong and receiving recommendations; it was about maintaining momentum and forging ahead. The stock’s breakout from horizontal resistance was a clear sign that the bulls were in control. Robust bullish candlestick patterns added further credence to this bullish trajectory.

Strong Technical Indicators

The foundation of CDSL’s success lies in its strong technical indicators. These indicators provide valuable insights into the stock’s performance, helping investors make informed decisions. For CDSL, these indicators have been consistently positive, fueling its ascent.

CDSL’s Strategic Position

Beyond the numbers and technicalities, CDSL’s strategic position in India’s growing equitisation landscape is a key driver of its success. As the Indian economy continues to expand, the demand for robust depository services like CDSL’s is on the rise.